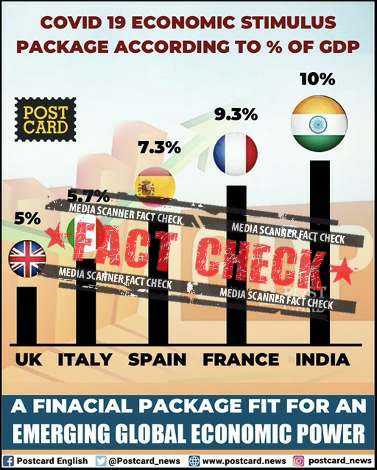

There are several news reports and graphs doing around on social media comparing India’s economic package with those of other countries. Although full details are still awaited on India’s package, we, through this article, would like to put in the public domain why these comparisons may be misleading.

Most (if not all) of the packages announced by various countries do not count their central bank’s liquidity infusion as part of the package. For example, the UK’s package does not count the staggering bond buying program of the Bank of England of 645 billion pounds. 645 billion pounds is nearly 28% of the UK Economy.

A central bank’s liquidity infusion does not come from the government coffers. Liquidity infusion, in layman’s terms, is primarily a tool used by central banks to increase money supply in the economy. They are not money spent by a government.

As was said by PM Modi, India’s package of 20 Lakh Crore however includes the Reserve Bank of India’s liquidity infusion. The details of how much of the RBI’s liquidity infusion will be counted in the 20 Lakh Crore package are still awaited, but news reports suggest they will not be less than 5 Lakh Crores.

The same holds for the EU countries and their respective economic packages. The aids packages of these countries do not count the 750 billion Euros of liquidity injection by the European Central Bank (the central bank of Eurozone countries). To put this in context 750 billion Euros is by itself 22% of German, 32% of French, 42% of Italian and 62% of Spanish GDP in nominal terms (prices from 2018).

Asad Rauf is Assistant Professor of Finance and Economics at Groningen University.